Oregon probate involves a legal process guided by court oversight to distribute a deceased's estate based on their will or state default rules. This process includes identifying assets, paying debts and taxes, distributing remaining assets, and maintaining records. Understanding Oregon probate basics is crucial for anyone with significant assets in the state to ensure legal handling of estate matters. Key terms include Oregon probate basics, probate law Oregon, Oregon estate law, probate process Oregon, and introduction to Oregon probate. Consulting experienced attorneys specializing in probate law Oregon is vital for navigating costs, timelines, and roles involved in the process.

Moving to Oregon? Navigating the state’s probate laws can seem daunting, but understanding these basics is crucial for managing your estate. This comprehensive guide simplifies Oregon probate for newcomers. We break down what probate is and who needs to go through the process, walk you through the steps involved, and highlight time frames and costs associated with Oregon estate law. Additionally, we explore designated roles and common scenarios, ensuring you have a solid understanding of probate in Oregon.

- What is Probate?

- Who Needs to Go Through the Oregon Probate Process?

- The Steps Involved in Oregon Probate Law

- Time Frames and Costs Associated with Oregon Estate Law

- Designated Roles in Oregon Probate Basics

- Common Scenarios and Exceptions in Understanding Probate Oregon

What is Probate?

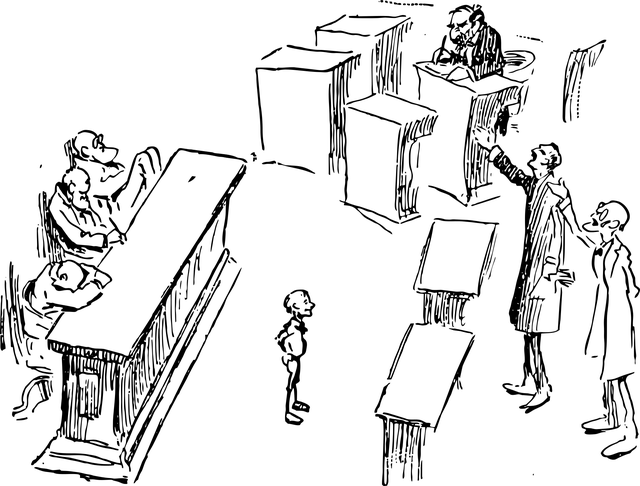

Probate is a legal process that’s often necessary when a person passes away, especially if they own property or assets in their name. In simple terms, it involves a court overseeing the distribution of a deceased individual’s estate to their beneficiaries. This process is crucial for ensuring that everything is handled fairly and according to the deceased person’s wishes, as expressed in their will or through other legal documents.

In Oregon, probate law outlines the procedures and requirements for this process. Understanding Oregon probate basics is essential for newcomers who wish to navigate the state’s estate law effectively. The probate process Oregon follows typically includes several steps: identifying and valuing assets, paying off debts and taxes, distributing remaining assets as per the will or Oregon’s default rules, and maintaining records of the entire procedure. This introduction to Oregon probate serves as a starting point for newcomers to grasp the fundamentals of managing an estate in this state.

Who Needs to Go Through the Oregon Probate Process?

The Oregon probate process is a legally structured framework designed to manage and distribute an individual’s estate after their passing. It’s a vital aspect of Oregon estate law, ensuring that assets are distributed according to the deceased person’s wishes as expressed in their will or, if there is no will, following state laws regarding intestate succession. This process is necessary for anyone who owns property, has significant savings, investments, or assets in Oregon at the time of their death.

Whether someone has a complex estate with multiple properties and businesses or a simpler one consisting of personal belongings and bank accounts, understanding Oregon probate basics is crucial. It applies to individuals with diverse backgrounds, from homeowners and business owners to investors and those with substantial savings. Familiarizing oneself with the probate process in Oregon can help ensure that estate matters are handled efficiently and according to legal requirements.

The Steps Involved in Oregon Probate Law

When navigating Oregon probate law for the first time, understanding the steps involved can feel overwhelming. However, by grasping the basic elements of the probate process in this state, newcomers can better prepare themselves and their families. The initial step is often filing a petition with the court to formally initiate the probate proceedings. This typically requires gathering essential documents, such as the deceased individual’s will or trust, along with other relevant financial records.

Once the petition is filed, a court-appointed executor or personal representative takes charge of administering the estate. They are responsible for managing assets, paying debts and taxes, and ultimately distributing the remaining property according to the terms of the will or trust. This process includes identifying and valuing all assets, notifying beneficiaries and creditors, and ensuring compliance with Oregon’s specific estate law requirements. An introduction to these probate basics in Oregon can help residents ensure their wishes are carried out smoothly and efficiently.

Time Frames and Costs Associated with Oregon Estate Law

Understanding the time frames and costs associated with Oregon estate law is a crucial step in navigating the probate process. In Oregon, the probate of a will typically begins after a death occurs and can take several months to complete, depending on the complexity of the estate. For smaller estates, the process might be quicker, while larger ones could face more extensive paperwork and potential legal challenges.

The costs involved in Oregon probate basics vary widely. Legal fees, court expenses, and administrative costs contribute to the overall price tag. It’s important for newcomers to consult with an experienced attorney specializing in probate law Oregon to get a clearer picture of expected expenditures. This initial investment can help ensure a smoother transition during what’s already a challenging time.

Designated Roles in Oregon Probate Basics

In an Oregon probate, various roles are designated to ensure the smooth administration of an estate. The process begins with a petition to probate the will, filed by a personal representative (often a named executor in the will). This individual is responsible for managing the deceased’s assets, paying debts and taxes, and distributing the remaining property as outlined in the will. They act as a key figure in the probate process, following the guidelines set forth by Oregon estate law.

Other crucial roles include beneficiaries, who are the individuals or entities that stand to inherit from the estate, and creditors, whose claims against the estate must be addressed. Legal professionals, such as attorneys specializing in probate law Oregon, play a vital role in guiding these processes, ensuring compliance with Oregon probate basics and the complex rules of Oregon probate process. Understanding probate Oregon is essential for newcomers navigating their first experience with an estate.

Common Scenarios and Exceptions in Understanding Probate Oregon

Understanding common scenarios and exceptions within Oregon probate law is crucial for newcomers navigating this complex area. Many situations can arise during the probate process, which serves as a structured method to distribute a deceased individual’s estate according to their wishes, or in the absence of a will, state laws.

One typical scenario involves a straightforward case where a valid will exists, outlining the distribution of assets. Alternatively, exceptions may include complex estates with multiple beneficiaries, contested wills, or situations requiring the appointment of a guardian for minor children. Each of these scenarios demands careful consideration and adherence to Oregon estate law, ensuring the probate process effectively manages the deceased’s wishes while protecting the interests of all involved parties.